artículo semanal Petróleo en el Stock Market

Oil Weekly: OPEC's Supply Shift Reveals Oil Market Normalization

Summary

Crude inventories posted an unexpected build, following U.S driving season start.

Net oil speculative length weakens further despite strong short covering.

OPEC gradual output increase marks the beginning of the end of bullish oil market momentum.

Introduction

Welcome to my Oil Weekly report. In this report, I wish to discuss about crude oil inventories and net speculative positioning changes, based respectively on the Weekly Energy Information Administration (EIA) report and the Commodity Futures Trading Commission (CFTC) estimates, to assess investor sentiment on oil markets. Then, I identify key global and oil market developments and their impacts on iPath S&P Crude Oil Total Return Index ETN (NYSEARCA:OIL).

Crude and petroleum stocks

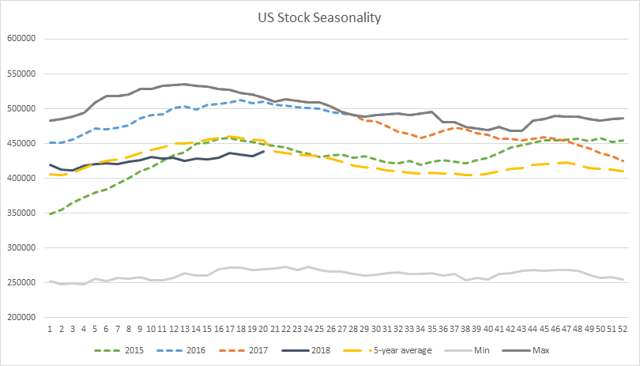

According to the latest EIA report, U.S. crude stocks unexpectedly rose, up 1.34% (w/w) or 5.7m to 438.1m barrels on the May 11-18 period, whereas Cushing inventories lost 3.02% to 36.1m barrels. With that build, oil stock seasonality moves slightly closer to its 5-year average but remains short of 16.5m barrels.

Source: EIA

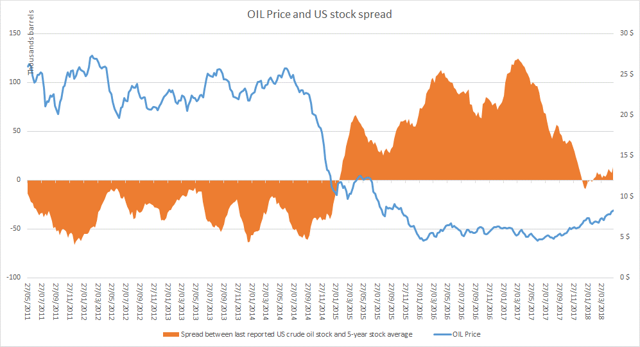

Following EIA's inventory accumulation, the five-year US crude oil storage spread further advances, totaling 13,011k barrels during the week and establishing at its highest level since its reversal in late December 2017.

Source: EIA

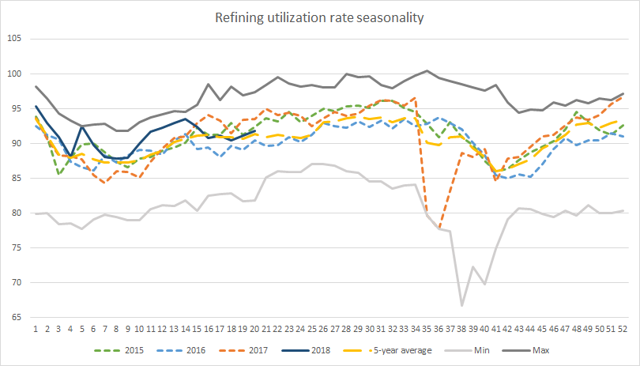

Concomitantly, refined petroleum inventories evolved in opposite direction. Gasoline stocks climbed slightly, up 0.81% (w/w) to 233.9m barrels, whereas distillates declined by a similar rate, down 0.82% to 114m barrels. Meanwhile, refining utilization rates posted a minimal rise, up from 91.1% to 91.8%, evolving in the 5-year normal range for the fourth consecutive week. Given the unexpected storage build, U.S. strong shale production could have a stronger impact on overall inventories, which in turn will pressure OIL's price.

Source: EIA

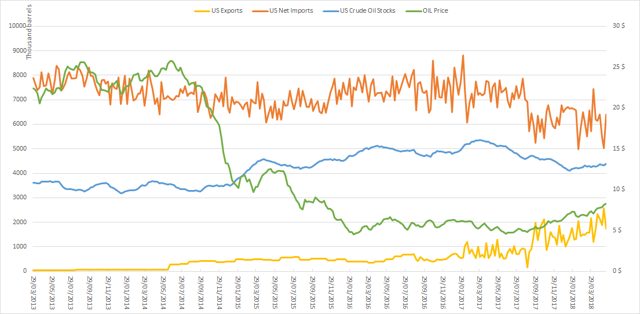

In the meantime, U.S. import/export oil balance depreciated over the week. Indeed, with exports steeply declining, down 31.88% (w/w) to 1.75m barrels and net imports lifting 27.33% (w/w) to 6.41m barrels, U.S. oil balance lost all its last week gain.

Source: EIA

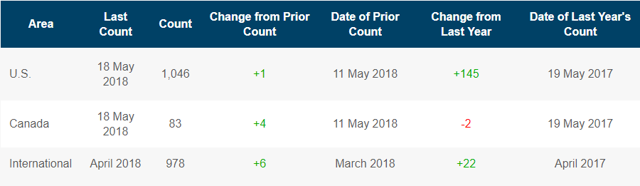

U.S. oil production posted a marginal appreciation, up 0.02% to 10.73 m barrels, despite strong Baker Hughes oil rig report and appreciation in oil price. On the May 11-18 period, U.S. production should remain even, following only one additional oil rig completion, which might further boost investor's bullish positioning.

Source: Baker Hughes

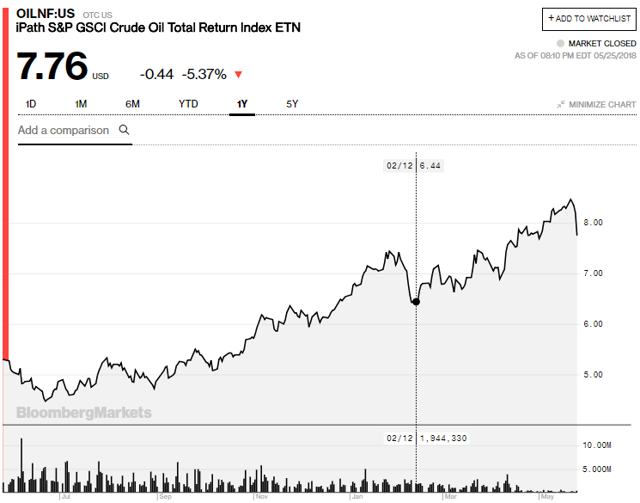

With unexpected crude inventories rise, OIL advanced moderately on the corresponding week, up 1.72% to $8.29 per share, but the steep correction witnessed this week, following growing rumors on OPEC's oil supply normalization, might indicate that the ETN's appreciation is over.

Source: Bloomberg

Speculative positioning

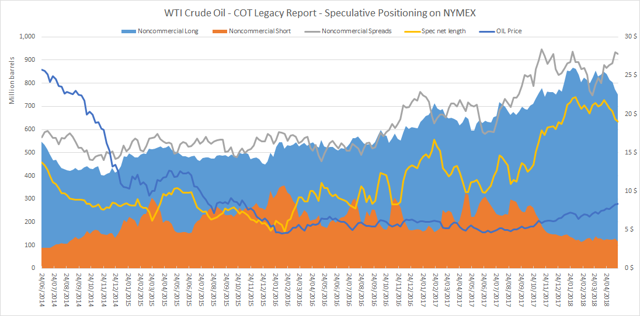

According to the latest Legacy Commitment of Traders Report ((COTR)) released by the CFTC on May 15-22 period, crude net speculative positioning on Nymex dropped for the fifth consecutive week, down 1.72% to 633,386 contracts. In the meantime, OIL continued to climb, up 1.82% to $8.41 per share.

Source: CFTC

Net speculative positioning decline is mainly due to long liquidations, down 2.87% to 750,320 contracts and is partly offset by strong short unwindings, down 8.69% to 116,934 contracts. Given EIA's bearish oil report and strong oil appreciation in the past months, oil correction might pursue in the coming weeks.

Since the beginning of the year, net speculative length further plunged (w/w) but remains slightly above its year to date figure, up 1.47% or 9,173 contracts, whereas OIL further advanced (w/w), up 27.81% to $8.41 per share.

OPEC supply rise will further weigh on oil markets

Since my last article, OIL lost 6.17% to $7.76 per share following OPEC's higher output plan. Indeed, Saudi's Energy minister, Khalid al Falih, recently said that oil supplies were likely to be increased gradually. This triggered on Friday an immediate effect on oil markets, which corrected steeply and might continue to do so once the details of the plan are revealed. Following this announcement, the cartel and its Russian ally seem to take seriously the recent warning that $70 or higher barrel price could further curb oil demand and thus economic growth. OPEC's focus now will be to stabilize international oil prices which will be much more difficult to apply than current output cut strategy. Nevertheless, the entente between Saudi Arabia and Russia will remain a crucial factor driving oil supplies and prices, easing market management conditions.

Besides, according to the New York Fed, oil demand slightly accelerated during the week but was totally offset by strong supply lift, up 6.2%. This is mainly attributable to current high oil prices, which are weighing demand and incentivizing oil producers to boost their extraction pace.

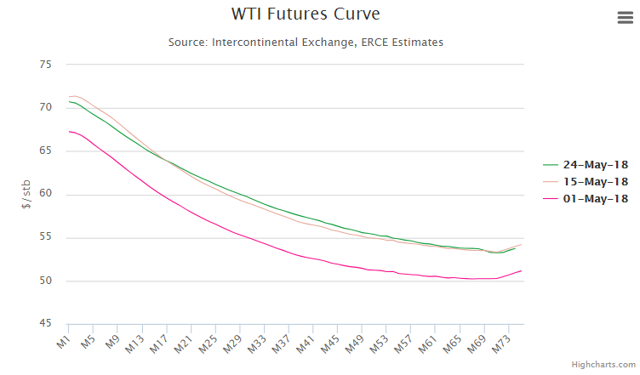

Furthermore, WTI futures curve remains in backwardation and has further flattened compared to last week. Recent oil market correction has contributed to this move and futures curve might reverse sooner than expected given upcoming June 22 OPEC meeting, where a plan to rise cartel's output should be confirmed. Moreover, greenback's surge compared to a panel of major currencies is not yet showing weakening signs and is adding further pressure on OIL's dip.

Source: Tradingview

With bearish U.S oil inventories and OPEC's gradual output rise, OIL prices might remain depressed for coming weeks.

I look forward to reading your comments. If you enjoyed the article, thanks for showing your support by following my account or sharing the article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Comments

Post a Comment