Diseney Potential Stock Market

Disney Is A Potential 3X Hidden In Plain Sight

Summary

Disney is beginning a business model change that will unlock tremendous value from its IP.

Its addressable market as an SVOD business is huge and it already has a brand-name advantage.

Current price is reflecting a low growth market outlook that is too short-sighted.

As Disney changes, mistakes will be made and will provide many entry points.

Disney (DIS), one of the most recognizable brands around the world (see hereand here). A brand we trust to cater to our children. A brand we grew up with. A brand that is still growing its influence worldwide.

I know it's old news by now, but please bear with me as I start this big-picture analysis with this excerpt from its Q3 2017 earnings call (emphasis mine):

Robert A. Iger - The Walt Disney Co. (CEO)Thanks, Lowell, and good afternoon, everyone. Besides today's earnings release, which Christine, will detail after my remarks, we're also announcing a major strategic shift in the way we distribute our content. We're excited by this change and see it as an important logical way for us to take advantage of the combination of our strong brands with the technological evolution the entire media business is undergoing. It's been clear to us for a while with the future of this industry will be forged by direct relationships between content creators and consumers.Given our incomparable collection of strong brands that are recognized and respected the world over, no one is better positioned to lead the industry into this dynamic new era, and we're accelerating our strategy to be at the forefront of this transformation. [...]As a direct result of this acquisition, we are greatly expanding our plans for the first ESPN-branded direct-to-consumer service. We're creating a more robust multi-sport package, which will give sports fans access to more live sports, 10,000 additional events annually including Major League Baseball, the National Hockey League, Major League Soccer, Grand Slam Tennis, and college sports. Additionally, we'll make individual sports packages available for purchase, including MLB.TV, NHL.TV and MLS Live.[...]Ultimately, we envision this will become a dynamic sports marketplace that will grow and be increasingly customizable, allowing sports fans to pick and choose content that reflects their personal interests. Our new direct ESPN service will be available to consumers in early 2018.Of course, one of the most compelling brands for a direct-to-consumer product is Disney, and to that end, we will launch a Disney-branded streaming service in 2019, which will be unlike anything else in the market. The new service will become the exclusive home in the U.S. for subscription video-on-demand viewing of the newest live action and animated movies from Disney and Pixar, beginning with the 2019 slate, which includes Toy Story 4, the sequel to Frozen, and The Lion King from Disney live-action, along with other highly-anticipated movies.We'll also be making a substantial investment in original movies, original television series, and short-form content for this platform, produced by our studio, Disney Interactive, and Disney Channel teams. Subscribers will also have access to a vast collection of films and television content from our library.

We all know how Disney's current model works. The company creates or acquires IP (intellectual property) and monetizes it in 4 major ways.

- Through its studio division that creates movies.

- The media division that sells content to cable and broadcasting TV networks.

- Theme parks where people go to immerse themselves in Disney's content and entertain themselves.

- Earning licensing fees from various products that are created based on Disney IP.

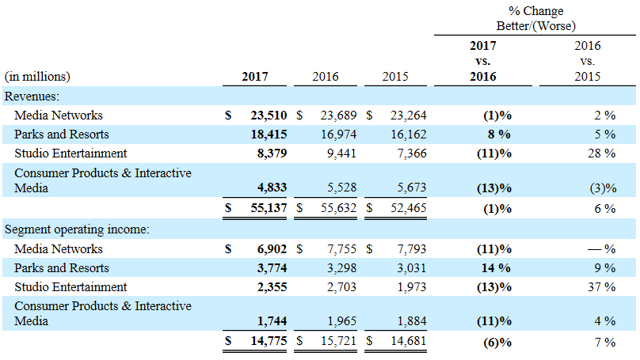

Below are the revenues & operating income each segment contributed last year (from Disney's 2017 10-K):

Now comes the crucial part. How would Disney look 5 & 10 years into the future under its new business model (SVOD)?

Netflix (NFLX) went from 22 mil subscriptions at the end Q3 of 2011 to 87 mil by the end of Q3 2016 (5 years later) and 125 mil at the end of Q1 2018 (6 and a half years later). While Netflix grew fast, Disney will grow faster due to its IP size and late-comer advantage.

Disney's content will probably be divided into 3 subscriptions. ESPN for sports, Disney for family programming, and Hulu for the rest. Now that Netflix has proven the value of a streaming service to domestic and international consumers, Disney's services will be even easier to sell. The company is already inside billions of homes worldwide and it will be a no-brainer choice for many households. Especially for those with small kids.

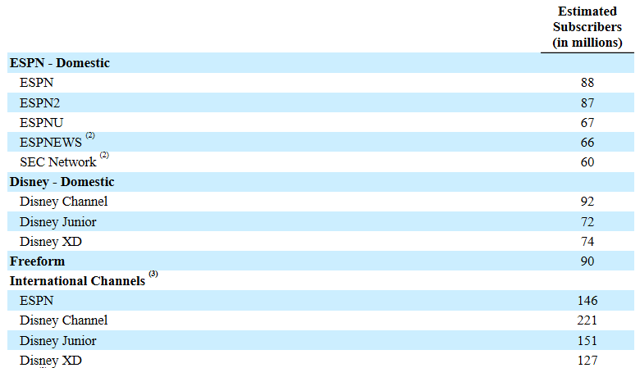

For Disney, reaching 200 mil subscriptions within 5 years seems reasonable as many households will have at least 2 subscriptions. And given the company's worldwide appeal, 600 mil subscriptions in a decade seems conservative. These numbers stem from the already huge number of Disney cable channel subscribers that exceed 1 billion (the table is from the latest 10-K).

Valuation Scenarios

5-year:

200 mil subs at $10 average monthly rate equal $24 bil of revenue. With the other segments growing a conservative 3%/year, we get total revenue of $60 bil.

10-year:

600 mil subs at $10 average monthly rate equal $72 bil of revenue. With the other segments growing a conservative 3%/year, we get total revenue of $114 bil.

At 25% operating margin and 15X multiple, we get a 5-year market cap of $225 bil (50% higher from now) and a 10-year market cap of $425 bil (280% higher from now).

Of course, these are predictions and the reality could be worse if Disney fails to deliver on its new streaming platforms. Or these could prove to be too conservative if the other segments grow faster, the company buys back stock, and/or the streaming services exceed my expectations.

Conclusion

The point I want to make with this article is that, in an SVOD world, Disney will do way better than Netflix. And given the market's short-term horizon, this will take some time before it is reflected in the stock price.

I for once will exploit the short-term bumps that will occur either because a quarter was missed or because a couple of films did poorly. I intend to build a long-term position with as low cost as possible and make it a cornerstone of my portfolio for the decade to come.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DIS over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

fuente: seekingalpha.com

Comments

Post a Comment